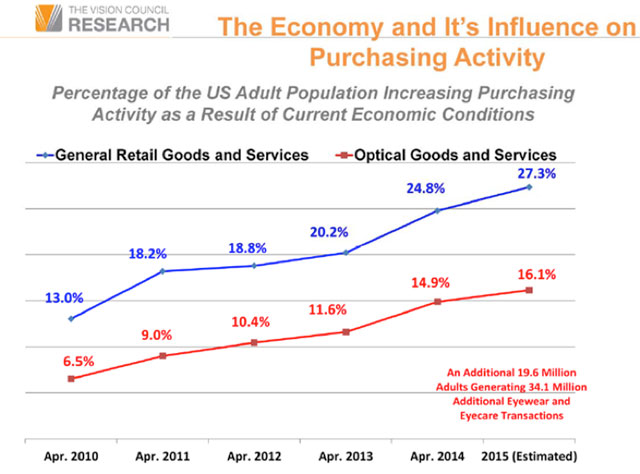

NEW YORK—From April 2009 through December of 2014, the slowly improving economy is responsible for a net increase of 19.6 million eyewear and eyecare customers generating 34.1 million transactions and up to $3.8 billion in additional optical sales, according to The Vision Council's senior director of industry research, Steve Kodey, in a recent VisionWatch report released during Vision Expo East.

While the U.S. optical industry is closely aligned to the state of the general U.S. economy, particularly consumer confidence and consumer spending, it is also a lagging and sheltered industry, which means that a slowdown in optical industry sales does not really start to occur until four to six months after any particular slowdown hits the general economy

Furthermore, when consumers slow their spending on goods and services they usually slow their spending on other non-optical goods and services to a greater extent than they do for optical products. So when times get tight and consumers slow their spending, they usually spend less on casual dining, electronics, clothing, entertainment, etc., first and then cut spending on optical goods and services and change their buying habits later on during a recession.

This is certainly what happened during the Great Recession five to six years ago. Back then, sales declined in the optical industry, but those declines were not as drastic or as severe as what other industries experienced. Unfortunately, while being a sheltered and insulated industry during bad times is often for the best, it can often be detrimental when the economy is booming and growing.

As this chart illustrates, while consumer spending on general goods and services has expanded considerably since early 2009, increases in spending on optical products as a result of the improving economy has only been about half the increase seen in the general retail economy, according to The Vision Council's VisionWatch report.

Should the economy turn downward, we will lose millions of potential buyers and transactions, but to reiterate, the losses of the optical industry will not be as bad or consequential as the losses other industries will experience.

Source: International Vision Expo East Statistics Committee Presentation 2015/VisionWatch, the large scale continuous research study conducted by The Vision Council with approximately 110,000 respondents.