By Marge Axelrad and Mark Tosh

Wednesday, June 29, 2022 1:00 AM

NEW YORK—After the shock of the 2020 pandemic and the slow build back to some semblance of stability by the end of that year, the leading U.S. optical retailers and companies, both national and regional groups, came back in 2021 with a solid mid-to-high double digit performance overall. While the 2020 year was characterized as working past store and office closures to “craft a comeback,” as

VM noted in our 2021 Top 50, the 12 months of 2021 were marked by tightening up operations, accelerating new digital technologies to power operations and to demonstrate new ideas to consumers and patients. Companies reconsidered initiatives like more online sales choices or remote eyecare.

By Marge Axelrad and Mark Tosh

Wednesday, June 29, 2022 12:59 AM

NEW YORK—In contrast to the harrowing year that was 2020, when the COVID-19 pandemic shook the world and forced many stores to close in the U.S for many weeks, the 2021 business year saw a comeback for the U.S.’s Top 50 Optical Retailers and groups, Vision Monday has learned. Based on submissions from companies as well as VM’s own estimates, the collective Top 50 Retailers’ sales for the 12 months ending 2021 ended up higher by some 21 percent from the previous year.

By Marge Axelrad and Mark Tosh

Wednesday, June 29, 2022 12:56 AM

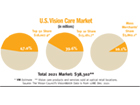

NEW YORK—Mirroring their overall companies’ sales performance in 2021, which saw the U.S.’ mass merchants and warehouse clubs reflect strong consumer buying activity and a healthy return to business after the initial pandemic year of 2020, those operations with optical departments experienced healthy gains as well. Collective revenues from this sector of the market rose some 16 percent for the year, reaching $3.86 billion in calendar year 2021, according to their reports and VM estimates.

By Marge Axelrad and Mark Tosh

Thursday, March 17, 2022 12:59 AM

NEW YORK—Today’s MyEyeDr., as an organization, is certainly different in scale and size from its origins 20-plus years ago. As co-founder and the CEO leading its vision and execution for the majority of those years, Sue Downes describes the continuously updated business to VM this way: “We’re bringing independent optometrists together, we’re bringing the medical model together and we have a unified name with a strong operational structure. Because of our elevated position, because of the parameters that we have, the states that we operate in, we can actually lead the industry in elevating eyecare into a medical eyecare space. And create a best in class retail experience as well.”

By Marge Axelrad and Mark Tosh

Wednesday, June 23, 2021 12:30 AM

The year 2020 was remarkable, presenting an almost unimagined range of challenges unheard of before COVID-19 became part of the lexicon. The result has been a wave of changes for everyone, whether at work or at home. Like many businesses, the optical/eyecare sector was significantly impacted by the long-running and continuing pandemic. Practices closed or operated with reduced hours over various time periods. Resiliency became the watchword.

By Marge Axelrad and Mark Tosh

Monday, August 10, 2020 11:00 PM

NEW YORK—The outlook was rosy in January and February. Business was strong, the eyecare and eyewear sectors were firing on nearly all cylinders, and, from the perspectives of many involved in practice transitioning and the acquisition of independent and group eyecare practices in the U.S., fueled by private equity firms and other investment models, 2020 was going to be another active year.