By Marge Axelrad: Editorial Director

NEW YORK—Although it’s usually eye doctors who pose the “Better or Worse?” question to patients during an eye exam, Vision Monday asked its readers to chime in about their third quarter and anticipated year-end performance in VM’s 6th and most recent How’s Business? Survey.

Combined with a consumer poll recently undertaken by VisionWatch, a joint survey of The Vision Council and Jobson Research, the two provide some glimpses into the mood of the market toward early 2010 and an assessment of the bumpy road created by the economic crisis affecting all business in 2009.

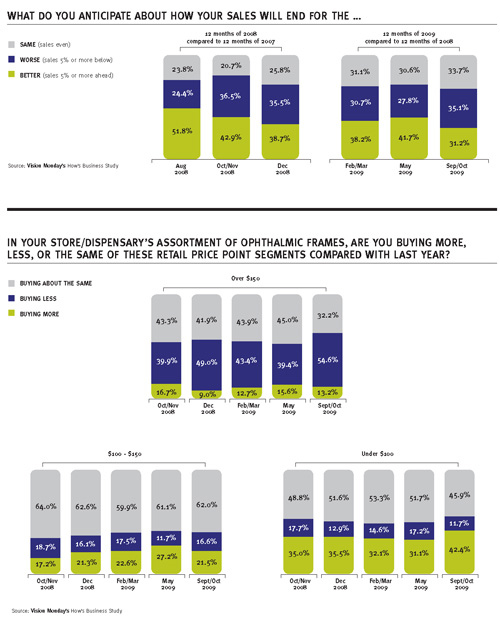

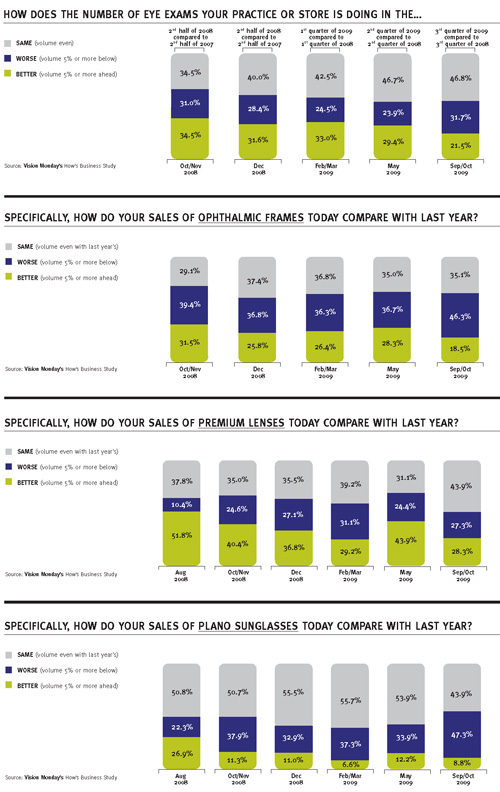

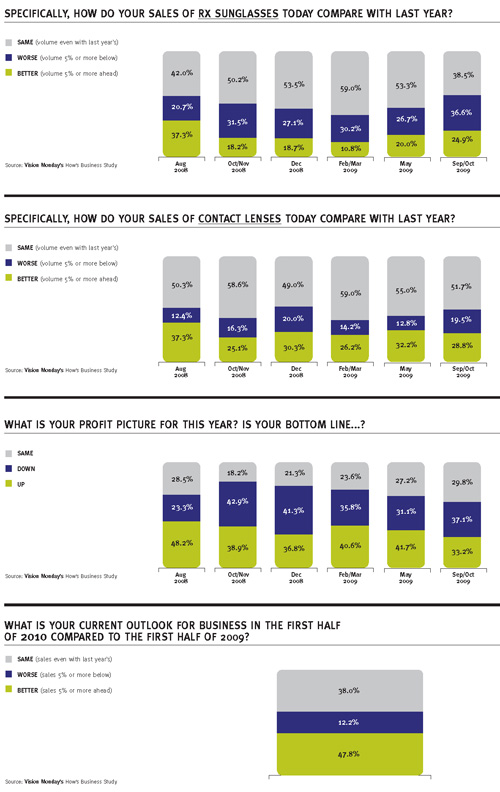

While reports of the country’s general merchandise retail sales have been reflecting some improvements over last year at this time and the stock market has been making gradual gains lately, ECPs and optical dispensers report that they are still experiencing softness on the sales and profit side through the third quarter—although close to two-thirds say they anticipate finishing the year flat or ahead of 2008.

In addition, optimism prevails toward next year—with 47.8 percent saying they anticipate sales will be better in the first half of 2010 compared to the first half of 2009, 38 percent saying they think sales will be the same and just 12.2 percent indicating they think things will be worse.

Eyecare professionals and optical retailers who took part in Vision Monday’s 6th “How’s Business?” Survey virtually all indicated that today’s consumer is more conservative, cautious and discriminating about their purchases. While many are shaving costs, still others are adjusting to the new climate.

“Consumers appear to be ‘on edge’ at this point,” said Diana J. Hall, Bard Optical, Peoria, Ill. “We watch each and every line on the financial statement to watch for any increases that cannot be explained. Once identified, we focus on the changes that need to take place to reduce the expense. It is important to say that we are working to review and/or renegoiate everything during these difficult times.”

Added James Podschun, OD, Winter Park, Fla., “Consumers are cautious. We are buying equipment that generates billable fees.”

“We’ve seen a longer span between purchases and patients are more careful with lens options,” said Jeff Yunker, Lifetime Vision Center, Grand Forks, N.D. “We’re reducing understocked frames, and buy stock contact lenses in volume for maximum discount.”

Compared to the previous surveys, initiated by Vision Monday in August 2008 and continuing through the year, the current outlook is a little more sobering than the uptick in optimism reflected in the March and May surveys toward end-of-year sales and profits.

In the latest one, spanning the September/October 2009 period, 31.2 percent of respondents are confident about finishing the year with sales 5 percent or more ahead of last year. There are fewer anticipating that now—41.7 percent were more confident of ending the year ahead of ’08 back in May and 38.2 percent said so in Feb/March.

Another healthy portion of respondents, 33.7 percent, believe they’ll end the year flat or even with 2008 sales, slightly more than the 30.6 percent who said so back in May. The economic situation and the consumer’s new spending habits, however, have apparently impacted the percentage of respondents who still anticipate ending 2009 with sales off 5 percent or more compared to last year as about a third, 35.1 percent, feel that way today in contrast to 30.7 percent who felt that way in Feb/March.

The 6th VM How’s Business? survey also reflects the continued transitions in the mix of what ECPs/optical retailers say they are buying in response to what their customers and patients are buying, which is a larger mix of moderate- and opening-price point frame products in comparison to high-end and luxury products.

Contact lens sales, premium lens product sales and Rx sunglasses, ECPs/optical retailers say, have been performing better than, overall, plano sunglasses and ophthalmic frames. This might reflect the increase in “lenses only” sales reported by the respondents as 24 percent in the Sept/October period in contrast to 21 percent back in Feb/March.

ECPs and retailers answering the survey tell Vision Monday they have been paring costs, adjusting inventories and controlling lab expenses to respond to the economy and the consumer’s new purchasing attitudes. Noted Miles Newman, OD, of Drs. Newman, Blackstock and Associates, in Roanoke, Va., “We are monitoring our remakes more closely and we have actually expanded and remodeled our five locations in the past year, which has had a positive effect on business.”

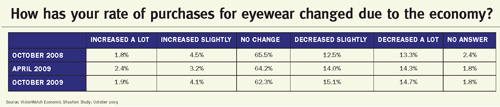

From the consumer’s point of view, the general pullback in spending hasn’t been as pronounced in optical as in other sectors. While only 6.1 percent of consumers have been increasing their purchases of eyewear over the past year, as a result of economic conditions, 30 percent of American adult consumers are decreasing their purchases of eyewear. Just under two-thirds of all consumers maintain there has been no change in their eyewear buying habits over the past year.

Certain demographics (men, younger Americans, Americans from higher-income households and Americans with managed vision care coverage) have been less affected by the economy.

However, two groups whose purchasing behavior tends to drive the industry in the U .S. —women and Americans over the age of 45—say they have continued to slow their eyewear products purchasing as a result of the economic slowdown.

The VisionWatch survey conducted in October 2009, compared to the one initiated in October 2008, indicates there are certain optical products and services which are more adversely affected than others.

In particular, purchasing intent for refractive surgery is strongly impacted, compared to just slightly for prescription eyeglasses and over-the-counter readers. Contact lenses and eye exams seem to have been a little more insulated from the slowdown, the survey indicates. ■

—maxelrad@jobson.com